How AI for Home Health and Hospice Is Transforming the Industry: Inside Insights from the July 17 SimiTree Webinar

Home health and hospice agencies are facing tighter margins, rising acuity, and a workforce under strain, and artificial intelligence is emerging as a real solution. On July 17, SimiTree hosted a powerhouse panel exploring what AI adoption looks like in real home health and hospice agencies, with perspectives from providers already testing and deploying these tools.

Moderated by Jarrett Bauer, CEO of Montauk AI, the panel featured Mark Romano, Vice President of Mergers & Acquisitions, SimiTree, Fred Johnson, President & CEO, Team Select, and Jennifer Brullo, DNP, MBA, MSN, RN, NE-BC, President/CEO, VNS Westchester.

This 30-minute discussion covered current use cases, measurable outcomes, buyer trends, and practical next steps for providers ready to explore AI.

Why AI in Post-Acute Care…and Why Now?

The panel aligned on one clear message: the pressure on home-based care has never been greater, and traditional models can’t keep up.

Jennifer Brullo of VNS Westchester opened with the operational reality. “Patient acuity is rising while expectations for better outcomes are as well. Manual processes can’t keep pace with payer requirements, and the cost of doing business keeps rising.”

Fred Johnson pointed to margin pressures as a key driver: “We’re asking, how do you grow without doubling your back-office and clinical staff? AI helps you scale, but it has to be strategic.”

Use Case #1: Predictive Hospitalization Tools

President and CEO Fred Johnson talked attendees through the process of how Team Select, a pediatric-focused home healthcare provider with 12,500+ employees across 15 states, built the industry’s first AI tool to predict hospitalizations in respiratory patients, in partnership with Cuesta Partners.

Their pilot focused on simple, high-impact interventions. “We hypothesized that trends in vitals and symptoms could signal early risk,” said Johnson. “We built an alert system using clean, discrete data points tied to the clinician’s workflow.”

The result? AI flagged a child with concerning vitals. That alert led to a chest x-ray and dthe iscovery of a second infection. Hospitalization was avoided.

The team rolled the pilot out to just 7% of case managers initially and built weekly learning loops for continual improvement. “It worked because we started small, focused, and had clean data,” Johnson emphasized.

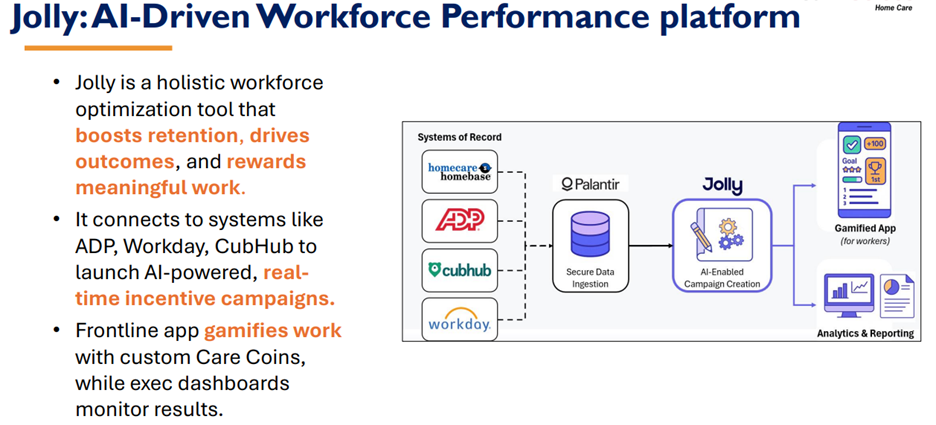

Use Case #2: Workforce Performance with Gamified AI

Team Select also deployed “Jolly,” an AI-powered workforce management platform. It connects with systems like ADP, Workday, and CubHub to launch real-time incentive campaigns based on documentation and performance metrics.

“The frontline app uses Care Coins to gamify documentation and quality metrics,” said Johnson. “It’s not just about productivity — it’s about retention and meaningful work.”

The numbers speak volumes:

- +1.5x on-time documentation

- +518% increase in referral submissions

- +1.43x retention

- $4–6M in projected incremental revenue from improved referral handling

Use Case #3: Referral Automation, Documentation Accuracy, and Forecasting

At VNS Westchester, Brullo shared how AI tools are being used to extract and summarize referral data, reducing errors and accelerating admissions.

“Admitting clinicians understand patient history faster, and we get to ‘yes’ faster,” she said. AI also helps her team with clinical documentation, easing the burden of QA oversight and improving OASIS accuracy.

“We’ve seen dramatic improvement in start-of-care submissions, time spent on documentation, and overall clinician engagement,” Brullo added. She mentioned the AI scribe tool as an example, called Nestmed.

VNS Westchester is also using AI for financial forecasting. With accurate predictions of patient volume and seasonal trends, they’re able to plan staffing levels more precisely and make data-informed strategic decisions.

What Buyers Are Looking for in 2025

Mark Romano brought the SimiTree M&A perspective, noting that private equity and strategic buyers are shifting from “scale” to “scalability” because the market has evolved: buyers are no longer just looking at how big you are, but how efficiently you can grow.

Romano emphasized that higher operating margins = higher valuations. AI has become a core part of that equation, helping providers improve productivity, streamline referrals, and enhance quality scores, all of which directly affect both value-based purchasing and enterprise value.

“Buyers want to know you’re efficient,” he said. “They’re looking for providers who can grow without growing overhead.”

Romano outlined the key characteristics that now define a scalable provider:

- A strong operational structure and clinical infrastructure

- Ability to forecast growth accurately with AI and analytics

- Tools in place that support margin expansion and labor efficiency

- Consistent quality performance tied to outcomes

He noted that buyers are increasingly evaluating AI’s role in:

- Referral acceleration and growth enablement

- Financial forecasting and pro forma accuracy

- Improving operating margins

- Supporting value-based care infrastructure

He also shared updated market insights from SimiTree’s M&A activity through Q1 2025:

- Activity is trending above 2023 and 2024 levels for home health, hospice, and home care, but still below the 2020–2022 peak years

- There’s increased buyer interest in private duty and Medicaid providers

- Hospice deal volume remains low, but interest is picking up

- Certified home health deals may slow or pause due to the uncertainty introduced by the CY 2026 proposed rule

“Market conditions are causing buyers to get more selective,” Romano said. “The ones getting premium valuations are those who’ve built infrastructure that supports scale, compliance, and consistent outcomes, and AI is now part of that expectation.”

The Diligence Readiness Factor

Romano emphasized that while innovation and AI can strengthen your position, diligence readiness is what ultimately closes a deal. Buyers are conducting deeper assessments than ever, and agencies need to be ready on both financial and clinical fronts.

On the financial side, preparation should include:

- Clear adjustments to EBITDA and operational income, especially for conversion from cash to accrual accounting. This is particularly important if your agency has seen major volume shifts or revenue fluctuations.

- Non-recurring revenue and expenses must be disclosed and scrubbed appropriately, including pandemic-related items like ERTC credits, one-time legal fees, or any personal expenses that may be flowing through the business.

- Understanding performance trends, not just over the trailing twelve months (TTM), but zooming in on the trailing 6 months (T6M) and 3 months (T3M) to capture recent stability or volatility.

Romano recommended that sellers:

- Conduct a sell-side financial review to identify and clean up any reporting inconsistencies

- Develop a supportable valuation story grounded in normalized earnings

- Prepare for VBP-related impact analysis (for home health)

- Conduct a CAP analysis (for hospice)

On the clinical side, buyers are digging into two primary risk categories:

- Billing Risk – If previously billed and paid claims are flagged during audits post-close, the buyer typically assumes the financial hit. Romano warned: “If there’s takeback exposure, it can affect deal terms or even derail a transaction.”

- Census Risk – If documentation doesn’t support medical necessity or eligibility, the buyer may end up with a book of business that isn’t defensible. “That’s a huge concern in hospice and increasingly in home health,” he said.

To mitigate clinical risk, Romano strongly advised agencies to:

- Complete a sell-side billing audit and compliance risk review

- Address any gaps early and leverage those findings to improve operations before going to market

“Being diligence-ready isn’t just a checkbox,” Romano said. “It’s the difference between getting to the table with leverage or being asked to justify things that should have already been addressed.”

Read how SimiTree provided due diligence support for Eden Health’s acquisition of A Plus Hospice Care.

AI Isn’t a Silver Bullet… But It’s a Competitive Edge

Fred Johnson closed with a pragmatic take: “AI won’t fix everything overnight, but it will separate those who prepare from those who fall behind.”

Each panelist echoed the importance of compliance and clinical oversight. “AI must support, not replace,” Brullo added. “It’s a partner, not a clinician.”

Key Takeaways for Providers

- Start with clean data and focused pilots

- Use AI to assist, not replace, clinical teams

- Track ROI through metrics like documentation time, referrals, and margins

- Prepare for scrutiny — transparency in AI logic is critical

- Position your agency for growth with AI as a core part of your infrastructure

Watch the Full Webinar

Missed the live event? Find the webinar on our webinars page to watch at your convenience and hear directly from leaders on the front lines of innovation.

Connect with an Expert

Want to learn how AI can support your home health or hospice agency?

- Contact Emily Boeglin at emily.boeglin@simitreehc.com to connect with an expert immediately.

- Submit a form at simitreehc.com/contact-us

- Call us anytime 800-949-0388

- Watch our webinars