MA plans account for quarter of revenue

MA plans account for quarter of revenue

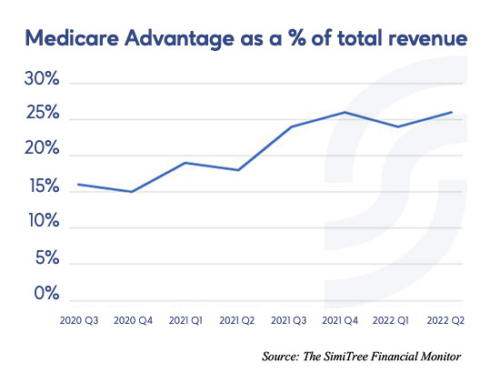

Medicare Advantage is projected by industry advocacy groups to be the dominant form of Medicare within the next two years, and SimiTree data analysts say MA plans already account for a quarter of home health revenue.

Data tracked by The Financial Monitor, SimiTree’s industry-leading data analytics and benchmarking tool, shows MA plans accounting for an increasing percentage of total revenue since 2020, and hovering at approximately 25 percent over the past four quarters.

Specifically, The Financial Monitor shows:

- 2021 Q3 Medicare Advantage 24%, traditional Medicare 59%

- 2021 Q4 Medicare Advantage 26%, traditional Medicare 57%

- 2022 Q1 Medicare Advantage 24%, traditional Medicare 57%

- 2022 Q2 Medicare Advantage 26%, traditional Medicare 55%

“Agencies need to make certain to track revenue and monitor margins and utilization for all payor plans – especially Medicare Advantage, as it is about 25 percent of your revenue,” said Brian Martin, Vice President of the SimiTree Financial Monitor.

Approaching the 50% mark

In 2022, more than 28 million people are enrolled in a Medicare Advantage plan, or about a 48 percent enrollment share of the eligible Medicare population, according to the Kaiser Family Foundation (KFF), a nonprofit organization that tracks national health issues.

Between 2021 and 2022, total Medicare Advantage enrollment grew by about 2.2 million beneficiaries, or 8 percent – a slightly slower growth rate than the prior year (10%). The Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to 61 percent by 2032.

For 2022, 3,834 Medicare Advantage plans are available nationwide for individual enrollment, part of a burgeoning number of varying insurance plans and requirements that SimiTree consultants say are changing the dynamic of home health billing. Read more here about the increasing workload caused by a decline of traditional Medicare and a growing number of other plans.

While the growth in number of plans varies across states and counties, KFF reports more growth occurring in Texas and Florida than other states.

SimiTree data analysts keep a sharp eye on industry trends and market dynamics, tracking numbers to stay abreast of developments and provide information agencies need for smarter decision making. The SimiTree Financial Monitor is an in-depth proprietary financial report SimiTree delivers to subscribers in quarterly increments to enable industry comparisons, benchmarking, and trend identification for stronger and more informed decision making. Read more about The SimiTree Financial Monitor here.

MAP, our Market Analysis Program, quantifies current and trended market share of all providers, providing the data needed for agencies to pinpoint high-value referrals and better understand the market, access profiles of other providers – competitors and referral partners – including service footprint, revenue trends, quality scores, and patient movement patterns. Read more about MAP here.