With inflation outpacing market forecasts and accelerating in May at the fastest rate in 41 years, home health and hospice providers are keeping a sharp eye on rising costs.

The U.S. Bureau of Labor Statistics reported June 10 that the consumer price index, a wide-ranging measure of goods and services prices, rose 8.6 percent from a year ago, for the fastest increase since December 1981.

“Understandably, the inflation rate has home health and hospice providers very concerned about rising costs,” said Brian Martin, Vice-President of The Financial Monitor, SimiTree’s industry-leading data analytics and benchmarking tool.

“Our subscribers are appreciating the opportunity to monitor costs quarter-over-quarter with the data provided by The Financial Monitor,” Martin said.

One of the metrics tracked by The Financial Monitor is hospice ancillary costs. These are costs an agency incurs outside of direct care when providing care and services to a patient.

Ancillary hospice costs include medical supplies, durable medical equipment and oxygen, drugs and infusion services, chemotherapy, labs and diagnostics, as well as costs the agency incurs for transporting the patient.

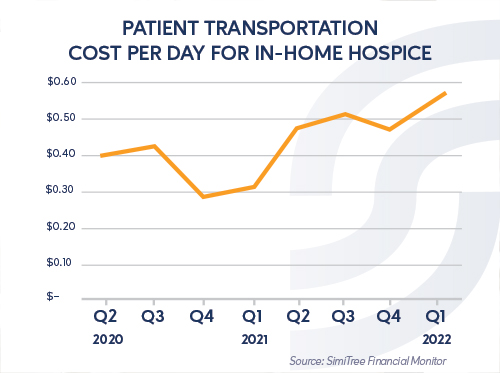

“Patient transportation costs is one example of ancillary costs where we are seeing a steady climb over the past six quarters,” Martin said.

In the first quarter of 2022, the national benchmark for in-home hospice patient transportation per day was $0.57, an increase of 20 percent over the same benchmark of $0.46 in the fourth quarter of 2021.

The patient transportation cost represents only about 3 percent of the total ancillary cost for in-home hospices, Martin said.

“Not every in-home hospice we analyzed saw their costs for patient transportation go up, but the majority we analyzed did, with about a third of the providers seeing their costs nearly double,” Martin said.

The IRS mileage rate increase

In-home hospices could see patient transportation costs increase again on July 1 if ambulance services or other transportation providers pass on a new increase in IRS mileage rates.

In a rare mid-year move prompted by fuel costs, the IRS is increasing its rate for business travel by 4 cents, from 58.5 cents to 62.5 cents. The last time the IRS increased a rate mid-year was 2011. The increase becomes effective July 1.

“Whether hospices see another increase in their patient transportation costs as a result of this IRS increase depends on whether they are using ambulance services and if the transportation providers raise their rates as well,” Martin said. “This is one of the many ancillary cost metrics we are tracking in the Financial Monitor.”